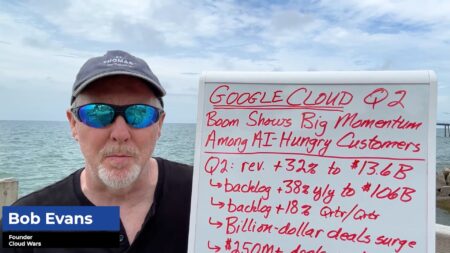

Google Cloud’s AI-native infrastructure and enterprise partnerships are fueling its fastest growth rate in years.

Salesforce

Nicus helps large enterprises connect technology costs to business value through AI-powered analytics.

The Cloud Wars Top 10 have surged past a $10 trillion market cap, reflecting unprecedented business confidence in the AI- and cloud-powered future.

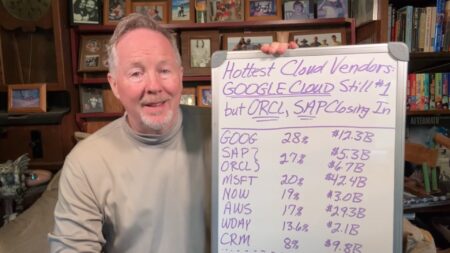

Oracle and SAP have rebranded themselves as cloud-first AI powerhouses, rivaling Google Cloud’s dominance.

The latest Cloud Wars update reveals strong growth across major cloud providers, with shifting dynamics that signal an increasingly competitive and evolving market.

The Cloud Wars Top 10 have secured $915B in contracted future business, signaling extraordinary long-term demand for cloud and AI services.

Cloud investment momentum continues despite political and economic uncertainties, driven by AI’s transformative promise.

Once doubted, Oracle’s cloud strategy pays off big as it reports a 41% RPO surge and forecasts FY26 cloud growth over 40%, led by relentless AI infrastructure demand.

With the launch of ASOR and its new Agent Partner Network, Workday is enhancing how organizations integrate and manage AI agents alongside human employees securely and efficiently.

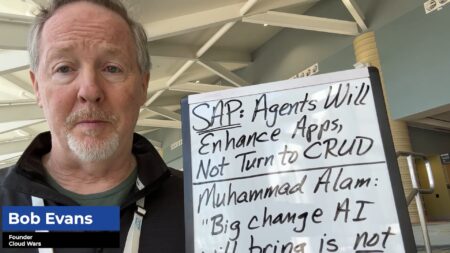

At SAP Sapphire, SAP counters the “apps collapse” narrative by asserting that AI agents will enhance enterprise applications.

Workday rejects the agentic AI hype, instead emphasizing practical business outcomes with its expanding AI portfolio aimed at delivering measurable impact across functions.

Advanced Copilot functions include search and notebooks, while new agents deliver on the promise of an integrated human-AI workforce that’s quantified in new research.

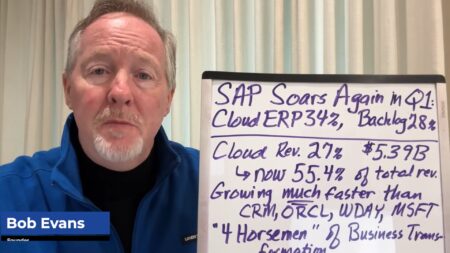

SAP dominates the enterprise cloud race in Q1, outperforming rivals with rapid growth in cloud and ERP revenue.

SAP delivered a standout Q1 performance, with cloud revenue surging 27% and its Cloud ERP suite up 34%, solidifying its lead over enterprise-app rivals.